Security Compliance

Bitbuy is one of the safest crypto exchanges for Canadians. The Blockchain Intelligence Group has completed its third annual proof of reserves and due diligence report confirming that Bitbuy exceeds its mandate requiring 95% of customer funds to be held in cold storage. Bitbuy keeps 98% of Bitcoin, Litecoin, and Ethereum funds in cold storage, which is one of the highest percentages we’ve seen.

Newton does daily backups to minimize risk and states on its website that customer data is stored in Canada. They also perform daily site backups, have offline third-party storage for digital assets, and they allow their customers to directly connect their bank account to reduce fraud.

Newton says it keeps “most” of its assets offline, held by a third-party custodian called Balance. We think the security of customer assets should be more transparent than this. Newton says it does daily backups to minimize risk and keeps customer data stored in Canada.

As for Bitbuy, it is fully transparent about its security. The Blockchain Intelligence Group has completed its third annual proof of reserves and due diligence report confirming that Bitbuy exceeds its mandate requiring 95% of customer funds to be held in cold storage. Bitbuy keeps 98% of Bitcoin, Litecoin, and Ethereum funds in cold storage, which is the highest percentage we’ve seen. If Newton could boast 98% of funds in cold storage, we think they would mention that. Bitbuy is a clear winner here.

Regulatory Compliance

Bitbuy is an industry leader in Canadian regulatory adherence and compliance. In addition to being a Virtual Asset Service Provider and registered Money Service Business with FINTRAC, Bitbuy’s leadership team is a member of the IIROC Crypto-Asset Working Group, which helps to set high-quality regulatory standards and strengthen Canadian markets.

Newton is fully compliant with FINTRAC regulations in Canada.

Newton and Bitbuy are both fully regulated in Canada. The exchanges are registered with FINTRAC and can operate in all provinces.

Bitbuy is an industry leader in Canadian regulatory adherence and compliance. In addition to being a Virtual Asset Service Provider and registered Money Service Business with FINTRAC, Bitbuy’s leadership team is a member of the IIROC Crypto-Asset Working Group, which helps to set high-quality regulatory standards and strengthen Canadian markets.

Customer support

Binance has FAQs and a knowledge centre on their website. They make it easy to submit a support ticket but the reply might take a while.

Newton has FAQs and a knowledge center on the website. Customers can message the support teams either online via their support pages or through email. Newton does not have a phone and live support.

Newton and Bitbuy have FAQs and knowledge centres on their websites. Customers can message the support teams either online via their support pages or through email on weekdays and weekends.

Conclusion

Both Newton and Bitbuy offer Canadians a simple way to buy cryptocurrency in Canada.

However, we think Bitbuy is the clear winner for several reasons.

When comparing Newton to Bitbuy, one notable advantage is the Recurring Buys feature. This allows users to automate crypto purchases at regular intervals, making it easier to invest consistently over time. Additionally, Newton has partnered with Koinly, a leading crypto tax platform, simplifying tax reporting with seamless integration. These features are especially beneficial for users looking for a hands-off approach to crypto investing and tax management, giving Newton a distinct edge over many competitors that don’t offer these conveniences.

When comparing Bitbuy to other exchanges, it stands out with new staking options, allowing users to earn rewards, which not all exchanges offer. Bitbuy maintains its strong focus on security by keeping 90% of assets in cold storage, which is an improvement over the older claim of 95%. Moreover, the platform has revamped its fee structure to be more transparent and competitive, addressing past concerns about high fees. These updates solidify Bitbuy’s position as a reliable, feature-rich exchange, especially appealing to Canadian users seeking both security and earning potential.

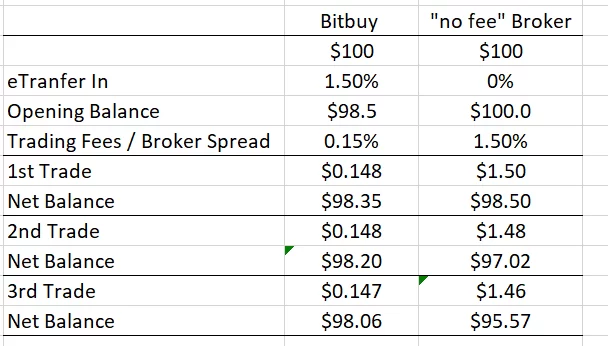

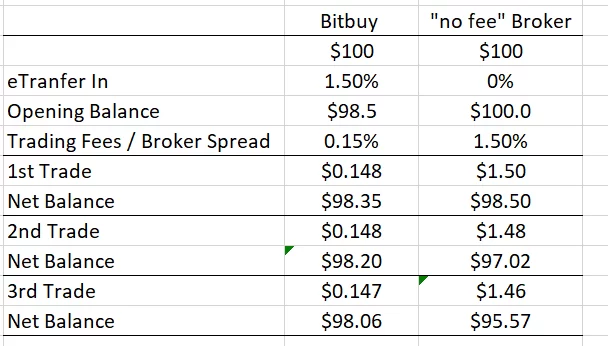

Newton states it is a “no-fee” exchange, but it makes money on the spread. With a crypto exchange, users buy and sell from each other, but with a broker such as Newton, it buys from its users and sells to them itself with a difference between the buy and sell price. This difference (the spread) is what makes Newton money. However, there is little transparency on Newton’s fee structure. While Newton appears to be the cheapest no-fee crypto exchange, it is not necessarily the cheapest of all exchanges.

Bitbuy is clear about what it charges its customers. Though it has deposit and withdrawal fees, Bitbuy has a much lower spread than Newton. A no-fee crypto exchange is not always the cheapest option as you can see in this table:

While Newton has more cryptocurrencies available, its advanced platform is not fully available yet. It is also a red flag that Newton is not fully transparent on what percentage of customer funds are held in cold storage.

Due to its highly regarded reputation, its transparency on security, its commitment to regulatory compliance, and its overall lower fees, we think Bitbuy is the clear winner when it comes to choosing a Canadian crypto exchange.

On top of these two, we would recommend Coinsmart for a number of reasons. Why? Check on our Coinsmart review.