When Bitcoin first appeared more than a decade ago, it was difficult to purchase in Canada. Nowadays you have so many options that it can be difficult to know which is the best way to buy crypto in Canada. As of November 20th, one Bitcoin costs $135732.83 CAD.

We’ve examined some of the most popular methods to bring you the ultimate guide on how to buy bitcoin & other crypto in Canada in 2024.

Disclaimer: Our website uses referral links to the crypto exchanges mentioned in the article as a means of monetization. This supports our efforts to provide high-quality, independently researched content for Canadians. Please be assured that our ratings are not influenced by these referral programs and our advice is always in the best interest of our Canadian audience. We appreciate it if you choose to use the in-article links, but the decision is ultimately yours.

1. Buy Bitcoin On Centralized Cryptocurrency Exchanges

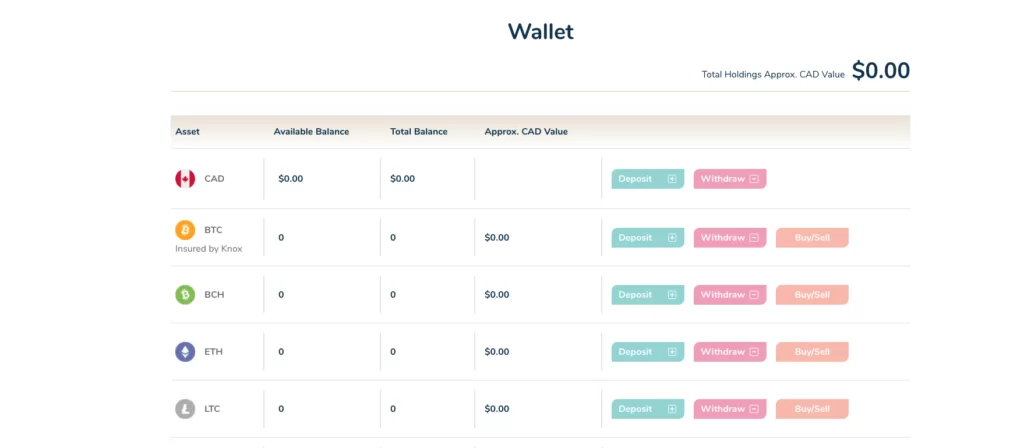

It’s the most popular way to buy bitcoin in Canada as of November 20th. Cryptocurrency exchanges account for 95% of the crypto trading volume. When you sign up to a cryptocurrency exchange Canadian users will need to verify your identity by going through a standard Know Your Customer (KYC) and anti-money laundering procedure. Once you’ve done that, you can then deposit Canadian dollars (CAD) into your account via Interac e-Transfer and start buying bitcoin and other cryptocurrencies.

Currently, Canadian banks seem to be against allowing their customers to buy cryptocurrency. Some credit and debit card transactions and bank transfers will go through, but more often not, Canadian banks block cryptocurrency transactions due to regulatory concerns.

It is best to find a bitcoin trading platform that accepts Interac e-Transfer to deposit CAD to your account on an exchange. We discovered those in our top-rated Canadian cryptocurrency exchanges article. The greatest place for beginner Canadian users to start trading crypto is Bitbuy. It’s a Canadian crypto exchange that follows the country’s regulations with extremely easy usability and great tutorials and they accept deposits via Interac e-transfer. It’s extremely easy to buy bitcoin for beginners. If you use this link, you’ll get a free $50 in bitcoin.

It is extremely simple to buy cryptocurrency on exchanges:

- Register on the crypto exchange for Canadians that works the best for your needs.

- Verify your account

- Add funds to your account (usually via Interac e-transfer)

- Buy bitcoin and other crypto assets

Pros to buy crypto via centralized crypto exchange:

- Most exchanges are beginner-friendly making it easy to buy crypto in Canada.

- You can withdraw your crypto off the exchange to a crypto wallet for safekeeping.

- Exchanges often have a wide variety of coins and trading pairs available.

- Cryptocurrency exchanges are reliable. They are built for the sole purpose of trading crypto.

- Easy to sell bitcoin or other crypto assets.

- Safe & Secure.

- There are many crypto exchanges that are fully compliant with Canadian laws.

Cons to buy crypto via centralized crypto exchange:

- An exchange will usually charge deposit and withdrawal fees to and from your bank account. They will also charge a trading fee to cover mining and validation costs, plus a commission on each trade when you buy bitcoin. When picking

- They are centralized, unlike a decentralized exchange (DEX). A centralized exchange acts as a third party to facilitate a crypto trade. Ultimately, they control your ability to buy bitcoin and can lock you out of your account, or lose your funds unless you transfer crypto assets to your external crypto wallet. This is what most Canadians do when they do not want to hold all the assets on the centralized crypto exchange.

- Hackers target exchanges and your crypto is at risk of theft if left on an exchange…. once again unless you transfer your crypto assets to an external crypto wallet.

- Not anonymous. You must verify your identity in order to trade. On the other hand, they do it to protect your account and assets so it’s barely a disadvantage.

- An exchange takes custody of your coins. You must withdraw your coins off the exchanges to an external wallet such as a hardware wallet in order to have complete control of your crypto.

- Higher trading fees

These are the most popular cryptocurrency exchanges for Canadians:

Newton

Newton is Canada’s first “no-fee” centralized cryptocurrency exchange. Newton doesn’t charge for deposits and withdrawals to buy cryptocurrency but there is a catch. Newton makes money on the spread. This is the difference between the buy and sell price, and Newton claims that because they buy and sell directly from users, it allows them to take advantage of the difference. That’s how they make money and this is why Coinsmart is still the best choice in terms of fees.

2. Buy Cryptocurrency Via Trading platforms

Covered in our best Canadian cryptocurrency exchanges article, Wealthsimple Crypto or Uphold are great for Canadian users who want to purchase Bitcoin or Ethereum as simply as possible with one of the most reputable platforms in Canada.

Similar to Wealthsimple Crypto trading platform, payments giant Paypal started allowing its US customers to purchase cryptocurrency in 2020 and plans to expand this internationally in 2021.

The process of buying bitcoin or other crypto assets on trading platforms is easier but your options are extremely limited:

- Register your account

- Verify your ID

- Connect your bank account

- Deposit funds

- Start trading

Pros to buy crypto via trading platforms:

- An easy and beginner-friendly way to buy bitcoin in Canada.

- Convenient for existing customers.

Cons to buy crypto via trading platforms:

- You do not hold custody of your assets and cannot move them off the platforms.

- You are issued an IOU – you are not taking ownership of the coin itself.

- High trading fees

If you decide to try Wealthsimple Crypto, I will highly appreciate it if you use my sign-up link (you will also get a free $50). We would also recommend Uphold over Wealthsimple, even though it’s a less popular choice for Canadians to buy cryptocurrency.

3. Buy Bitcoin On Decentralized Crypto Exchanges (DEX)

A decentralized exchange (DEX) is an advanced way to buy bitcoin in Canada. We would not recommend it if you are a beginner. It is similar to a regular centralized exchange (CEX) e.g. Coinbase, Binance, in that you can buy and sell crypto, but it is decentralized, meaning it is not controlled by a company or organization.

With a CEX, they take custody of your private keys, and therefore your crypto. A DEX is instead a peer-to-peer platform to trade cryptocurrency. It means you can buy bitcoin (or other cryptos) directly with another person, globally, without a middleman. Users connect their external cryptocurrency wallets containing crypto to the DEX to make trades with another user. Trades are executed via smart contracts. It is a more advanced way to buy cryptocurrency in Canada rather than cryptocurrency exchange and we would not recommend it to beginners.

Pros:

- Limitless trading pairs. If you would like to purchase Chainlink (LINK) with DigiByte there is sure to be someone out there willing to trade. You don’t have to rely on the limited amount of trading pairs offered by a centralized exchange.

- Anonymity. You can buy Bitcoin anonymously since KYC and anti-money laundering compliance is not required with a decentralized platform.

- Trustless transactions. When buying bitcoin on an exchange, that transaction is overseen by the exchange. With a DEX, transactions are executed via smart contracts making them “trustless”. A trustless transaction means that you do not have to rely on a third party (E.g. a centralized exchange) to handle the transaction. Instead, it is executed using the blockchain protocol itself.

- Custody of assets. The big benefit of a DEX is that you are retaining custody of your private keys and therefore your crypto. A centralized exchange takes custody of your private keys and therefore your funds could be lost due to a hack or if they block your account. By maintaining custody of the keys to your wallet, you have complete control of your crypto.

- Lowest trading fees to buy cryptocurrency. A DEX will charge a fee to cover the gas prices of executing the smart contract, but there are no commissions taken like there are with a Centralized exchange.

Cons:

- You can only trade crypto to crypto. There is no way to deposit fiat to a DEX via bank transfer and withdraw fiat to your bank account.

- Not a beginner-friendly way to buy bitcoin for Canadians. It’s much easier to buy cryptocurrency through an Interac e-Transfer or credit card through a centralized crypto exchange than it is to learn the process of trading peer to peer on a DEX.

4. Buy Cryptocurrency ETFs

In April 2021, Canada launched North America’s first Bitcoin Exchange Traded Fund (ETF) – Purpose Bitcoin ETF (BTCC). Cryptocurrency ETFs considered as one more way to buy cryptocurrency in Canada. This is why we made this list of the best bitcoin ETFs to invest in Canada.

An ETF is a fund containing stocks of several companies often grouped together by industry. A Bitcoin ETF is a managed fund that gives investors the opportunity to invest in Bitcoin without the hassle of signing up to a cryptocurrency exchange and managing a wallet. A fund is managed for you making it incredibly easy to invest. You are not buying bitcoin itself though.

Here are some Bitcoin ETFs that trade on the Toronto Stock Exchange. You can buy shares in these ETFs using popular Canadian brokers such as Wealthsimple Crypto.

- Purpose Bitcoin ETF (BTCC): It is the world’s first bitcoin ETF. It trades under BTCC (CAD, currency-hedged), BTCC.B (CAD, non-currency hedged) and BTCC.U (USD, non-currency hedged) tickers. The management fee is 1%.

- Fidelity Advantage bitcoin ETF (FBTC): it has a much lower fee than some others at just 0.4%, but it has fewer bitcoins in its fund. It trades under FBTC ticker.

- CI Galaxy Bitcoin ETF (BTCX): it has quite a large fund at $486 Million. It trades under BTCX.B (CAD, unhedged) and BTCX.U (USD) tickers. The management fee is 0.4%

- 3iQ CoinShares bitcoin ETF (BTCQ): it holds $871 Million worth of bitcoin at the current price. It trades under BTCQ (CAD, unhedged) and BTCQ.U (USD, unhedged) tickers. The management fee is 1%.

- Evolve Bitcoin ETF (EBIT): You can buy the Canadian dollar ETF or the US dollar ETF. It trades under EBIT (CAD, unhedged) and EBIT.U (USD) tickers. The management fee is 0.75%

Pros to buy bitcoin via ETFs:

- Gives exposure to crypto without having to worry about storing your private keys safely.

- A convenient way to invest in crypto in Canada for beginners.

- Convenient for people who already invest in ETFs.

- Much like gold and silver ETFs, Bitcoin ETFs are backed by actual Bitcoins, not derivatives.

- You can hold Bitcoin ETFs in your TFSA and RRSP.

Cons to buy bitcoin via ETFs:

- You are relying on the brokerage to act as an intermediary. You must be able to trust your brokerage not to lock you out of your account or go out of business.

- Bitcoin ETFs incur management fees of approximately 1%.

- You do not hold the private keys to your Bitcoin holdings.

5. Buy Cryptocurrency Via Crypto ATMs

You can purchase bitcoin by simply using a special vending machine. The world’s first Bitcoin ATM was launched in Vancouver, Canada in 2013. There are now more than 19,000 crypto ATMs across 72 countries and over 1500 crypto ATMs in Canada.

Buying Bitcoin via ATM is simple in Canada:

- Get a crypto wallet

- Find Bitcoin ATM near you (you can find a map of ATMs across the world here)

- Select the coin you wish to purchase

- Scan the QR code of your wallet address where you want the coins sent to

- Insert cash, click send, and buy bitcoin.

Bear in mind that there are many types of crypto ATM with variations on the procedure.

While convenient, the downside to ATMs to buy bitcoin is the high fees. The majority of Bitcoin ATMs in Canada charge a fee of around 12-15%. Compare this with a typical 1.5% fee at a crypto exchange and you can see that using an ATM, even just once, is costly.

Pros:

- An easy and convenient way to buy Bitcoin, Ethereum, and Litecoin with cash and send it directly to a wallet.

- They are usually in convenient locations such as malls or coffee shops in cities.

Cons

- Crypto ATMs charge extremely high trading fees.

- You must use an ATM in person to buy bitcoin.

- They are not as common as regular bank ATMs.

6. Buy Crypto Over-The-Counter (OTC)

An Over-The-Counter (OTC) trade is made off the main exchange for trading bitcoin. This way to buy bitcoin in Canada is usually reserved for extremely wealthy customers who wish to purchase large amounts of Bitcoin, Ethereum, and other cryptocurrencies. These people are often known as “whales”. They negotiate a price with the exchange and it is conducted off-exchange at an agreed-upon date and time. It’s like having a personal shopper for your crypto. One of the best OTC crypto brokers in Canada is Bitbuy.

Pros:

- Acts like a custom service just for you to buy bitcoin in Canada.

- You won’t have to do anything yourself. Your account manager will execute your trades.

- You can agree upon a price, date, and time of a trade in advance.

Cons

- Only suitable for large volume trades.

- Might be challenging to buy crypto via bank transfer for Canadian users.

7. Buy Cryptocurrency Via Crypto Wallets

The last way to buy cryptocurrency in Canada is simply by using your crypto wallet.

Ledger is a European company that makes secure hardware wallets to store your digital currency. What makes Ledger so secure is that these wallets store your cryptocurrency offline making they are safe from hackers. When leaving your crypto on an exchange, your coins are at risk of theft or being lost. With a hardware wallet, you have ownership of your private keys and as long as you store them safely (offline) your crypto will remain safe.

You can purchase cryptocurrency with Ledger’s partner, Coinify, directly through Ledger Live for which you must have an account. Your purchased cryptocurrency will be sent directly to your Ledger account. You can buy Bitcoin, Ethereum, and many other altcoins through Ledger Live. It’s available for Canadian users as well. The process of buying and selling cryptocurrency is similar to crypto exchanges.

Pros:

- Ledger hardware wallets are the most secure way to store your crypto and digital assets.

- You have full custody of your digital currency.

- You can stake several digital currencies in your Ledger Live account to receive crypto rewards.

- You can easily swap one crypto for another.

- If you lose your hardware wallet, it’s not the end of the world as whoever finds it would need the wallet password as well as access to your Ledger Live account in order to move your crypto.

Cons:

- You are solely responsible for keeping your private keys and Ledger password safe.

- Ledger Live and its hardware wallets can be confusing for beginners.

- Ledger hardware wallets have a relatively expensive upfront cost.

We highly recommend ordering Ledger from the official website and not resellers like Amazon to make sure it has not been tampered. You can check other cold wallets options available for Canadians here.

Conclusion

In the end, you must choose the most suitable solution to buy bitcoin in Canada for yourself. The best way to buy crypto in Canada is the one that you are most comfortable with. Based on our survey, 94% of Canadians are buying and selling crypto via centralized cryptocurrency exchanges. We would definitely recommend it for beginners.

Centralized Canadian cryptocurrency exchanges such as Bitbuy are the most popular way to buy a cryptocurrency for Canadians, but with the rise of decentralized finance (DeFi), decentralized crypto exchanges are becoming popular too. If you are looking for a short-term investment or you don’t want to deal with the hassle of private keys, then a trading platform such as Wealthsimple, or a Bitcoin ETF, is a good choice. If you’d like to have full custody of your digital currencies, then buying them through Ledger Live, or an exchange, and transferring them to a wallet is the best way to go.

Crypto is becoming more mainstream by the day and there will no doubt be many other ways to buy bitcoin it in the near future.